When one hears the word “insurance”, they might associate it with the terms of health, auto, and life. The essential reason for having insurance is for benefits and protection. If a person gets sick and has to receive medical care, or gets into a fender bender and has to repair damage to their car, or even dies insurance provides a safety net to cover costs and provide coverage for services used. However, insurance is not just for individual use. Entire businesses (whether big or small) utilize insurance services, as well.

What is Business Insurance?

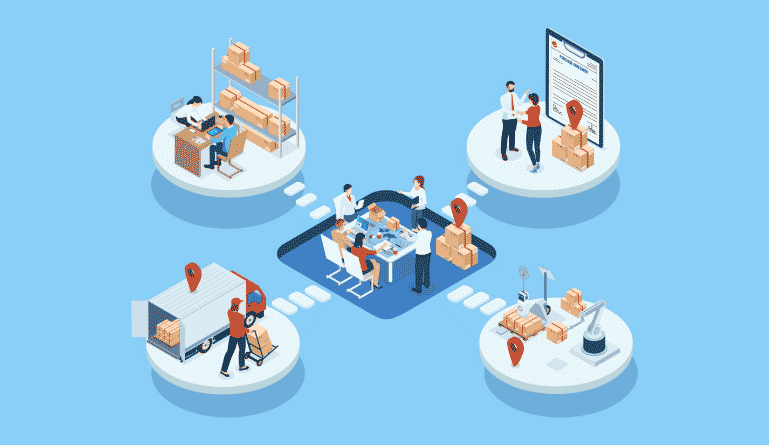

Businesses need protection against events that could cause monetary loss. Having coverage from multiple insurance policies ensures that a business can be covered for potential liabilities from having employees, producing materials, the work environment, etc. Operating a business requires having coverage for anything that could go wrong so that a single lawsuit does not cause bankruptcy.

How does Business Insurance work?

Business insurance is basically a formal agreement between a business and an insurance provider. The provider will help take on the risks of operations as long as the business provides pay installments for services provided. Ironically, you need money to protect money. If something happens and a business has a monetary loss, the insurance company covers that loss based on its maximum policy cap (usually after a business pays its deductible which is an fee payed upfront to start the insurance policy coverage).

Why is Business Insurance Important?

Having protection against unfortunate events like lawsuits, natural disasters, and even global pandemics like the Covid-19 ensures that operations can remain functional, so that monetary and asset losses are not so great that it negatively impacts business operations. Being covered by insurance also helps to keep workers employed and brings peace of mind to respective clients, sellers, & workers. Plus, it is required by law for a business to have insurance in order to protect employees who have disabilities, are unemployed, and for fair compensation.

What does Business Insurance Cover?

Below are the various risks that business insurance offers coverage for:

-

Public Liability

This policy protects businesses from judicial claims made against them and lawsuits filed by a public member of society (usually a former customer or client) due to bodily harm and/or damage on the company premises.

-

Professional Indemnity

The professional indemnity policy provides protection against customer claims of subpar products or services.

-

Employers’ Liability

When a company employee gets injured, becomes sick, or even dies while working, this policy covers the financial losses of potential lawsuits and compensation payments that are likely to occur.

-

Sales & Service Indemnity

This policy protects businesses against direct accusations made from a customer being harmed or injured on the premises due to the way a company provided a product or service. (Extension related to the Public Liability policy)

-

Buildings & Contents

Just as the name states, buildings insurance covers the physical structure of an actual business while contents insurance protects the materials/equipment inside of it.

-

Goods in Transit

When shipping purchased products to consumers, it is not guaranteed that they will reach the final destination in perfect condition or even at all. This policy ensures that if a product is damaged or lost in transit, that replacement costs are covered.

-

Business Interruption

If business operations are paused due to unforeseen events, such as a global pandemic, this policy restores the income that was lost during that period of time.

-

Money & Assault Protection

If a business falls victim to robbery then this policy will provide funds to replace what was stolen, injury sustained during criminal event, and counseling

-

Tools, Equipment, & Stock

This policy protects transportable tools, equipment, or livestock (animals) for a business in case of damage, loss, or theft.

-

Residential & Commercial Landlords

This policy covers whoever owns the property that a business resides in or is located at just in case that property is damaged or destroyed due to natural disaster or other circumstances.

-

Commercial Legal Expenses

Covers the defense costs of being brought to court due to a lawsuit which in include lawyer, court, and witness costs.

-

Contractors All Risk

Commonly used in the construction industry, this policy covers damaged property and personal injury related to the in or around the worksite.

(Download Whitepaper: The Changing Landscape of Insurance Billing)

Business Insurance Tips

- Conduct research before contemplating purchasing an insurance policy

- Learn how your business functions and operates to know what coverage your business will need

- Choose a qualified insurance representative

- Purchase a policy

- Constantly go over your policies to ensure that they cover all of your business’ needs

- Check to see if you can receive multiple policies under one plan since some are related to each other in terms of what is covered

- Update your policies as your business grows

- Pick goods plans that protect your workers and customers as good as they protect the business

- Modern problems require modern solutions. Make sure that you have insurance policies that cover the digital aspect of running a business as well

- The better your are covered, the better your business will be

Online Business Insurance Platforms in the US 2020

-

Gusto

Provides small businesses with health insurance coverage for its employees, 401(k) plans, commuter benefits, etc.

-

Oscar

Under its various plans, Oscar provides healthcare coverage for small businesses, individual, family, and Medicare advantage packages.

-

Bright Health

Offers health insurance in-person, online, and on-the go for small businesses

-

Root Insurance

Provides policies like car insurance, liability, bodily injury, and property damage coverage for businesses by signing up, measuring driving behavior, and choosing plans through their app.

-

Clover Health

Not only offers Medicare, but dental, hearing, and visual exams for workers. Members also have access to in-house visits from doctors and free gym memberships.

Types of Business Insurance Online

Discover the Online Business Insurance Coverage You Need

- General Liability Insurance: Anything involving physical injury, health costs, and damage to the property during a service or product provided is covered under this policy. It is recommended to have for the common risks of operating a business.

- Professional Liability Insurance: Also known as errors and omissions insurance, this policy covers mishaps, carelessness, and accidents during a service to a customer. It is commonly used by doctors, lawyers, and accountants.

- Workers’ Compensation Insurance: When life happens and an employee becomes ill or are hurt because of an accident on the job, this policy covers it. Every state has a specific requirement for workers’ compensation insurance, so do your research when choosing a policy under this plan.

- Cyber Insurance: This policy covers a business against digital attacks such as hacking and data breaches when dealing with stored personal customer information (social security numbers, credit card numbers, contact information, etc.).

- Commercial Auto Insurance: When a business provides means of travel to their employees, like company owned cars, coverage for possible car accidents, injuries, vehicle damages and mishaps is crucial for a company to have.

- Commercial Property Insurance: In the case of a natural disaster, a freak accident, or an arsonist doing damage to or destroying your property, having commercial property insurance makes sure that a business has coverage for the costs of repair.

Final Thoughts

The complexities of running a business with everything that could go wrong can be overwhelming for owners of a new or small business. That is why, as discussed in this article, it is imperative that a business owner does their research, learn the in and outs of their business, pick a good insurance broker or representative, purchase a policy, then monitor how it fits the needs of your company.

If a business is successful, it will grow. With growth comes more employees, more customers, and possibly more properties to operate. As a business needs grow, so does the coverage of the policy. Having someone to go through the insurance process with a business owner step by step ensures that all I’s are dotted, and all T’s are crossed.

In this era of a global pandemic, making sure that workers are covered financially and medically is essential to keeping employees with your business after Covid-19. Plus, making sure that your company is compensated for halted production ensures that you stay can in business, not only surviving, but thriving.

Running a business in this modern era is not as simple as making a product and selling it to consumers. It is protecting the business and its employees being completely disrupted from possible life changing events. Not only do have to think about how things are supposed to function, but also keep in mind how things could go wrong. Having insurance is all about having a plan and the benefits of having a plan might be costly now, but it is priceless in the long run.

As the old saying goes, “when you stay ready, you don’t ever have to get ready.”

***

Kierra Benson is an alumnus of the University of North Texas at Dallas with a Bachelor’s degree in Communication and Technology. She previously completed an internship at a local newspaper and worked as a content creator for a small online business. Her goal is to work in the media industry in writing/editing and advertising. She has always been fascinated by how messages are marketed in the media to influence the masses and sell products. Connect with her on LinkedIn.