The next few years are poised to be “the decade of FinTech.” Today, the sector comprises just 2% of financial service revenues worldwide; by 2030, BCG estimates that FinTechs will constitute almost 25% of total banking valuations. The ABCD technologies in FinTech – AI, blockchain, cloud, and data analytics- drive this revolution. Let’s explore the power of these standalone technologies in FinTech and the possibilities when used in synergy.

AI (Artificial Intelligence) in FinTech

Artificial intelligence (AI) refers to computing systems that can execute complex statistical analysis – processing large volumes of data, drawing correlations, and surfacing insights. Financial process automation is among the areas most impacted by AI in the FinTech sector. By leveraging sophisticated algorithms and machine learning techniques, AI systems can optimize processes, enhance productivity, and diminish the need for human intervention.

Data analysis lets AI algorithms autonomously conduct trading, investment management, and portfolio optimization. Also, they excel at risk assessment by identifying patterns and anomalies in historical data.

Chatbots are powered by artificial intelligence and offer round-the-clock customer support through natural-language conversations, ensuring prompt replies to inquiries and concerns. Today, banks run apps that require facial or biometric recognition – artificial intelligence is the primary enabler.

However, it’s vital to acknowledge and tackle the challenges and pitfalls linked to this A of the ABCD technologies in FinTech. To start with, safeguarding privacy and data is of paramount importance. To stay compliant, financial institutions and FinTech firms have to find a way to integrate AI into their operations while protecting customer data.

Ethical difficulties can also arise from bias and discrimination in AI-powered decision-making (regarding credit assessment, investments, and lending).

Blockchain Technologies in FinTech

Blockchain is a distributed ledger technology where data is stored in cryptographically encrypted blocks on a chain based on a consensus mechanism. It’s impossible to alter the contents of blockchain-based assets, and you can’t add to the blockchain without consensus.

Blockchain is frequently linked to cryptocurrencies like Bitcoin and carries extensive implications within the financial services sector. It facilitates transactions with a secure and unchangeable ledger, which minimizes fraud and eliminates the need for intermediaries. The next step in this progression is DeFi, or Decentralized Finance, which uses decentralized smart contracts.

Using blockchain technology can lead to substantial time and cost savings for enterprises. This is An instance of the extensive paperwork banks generally demand when opening small business accounts. The service can be delivered rapidly with blockchain, configuring to receive data from any source without human intervention.

Moreover, exchanges that previously required days to finish can happen in mere seconds on blockchain platforms, reducing your operational expenses – all powered by the fast and hassle-free delivery mechanism that’s baked into smart contracts.

Blockchain also enhances auditing and governance through a decentralized and auditable ledger of transactions.

Even though organizations increasingly adopt blockchain in FinTech, specific considerations must be considered. To begin with, the financial implications of incorporating blockchain technology are substantial, as it demands significant investments in software and hardware for the initial rollout. Further, the numerous alterations happening in the banking industry’s databases may give rise to problems around data modification.

Given how complex and unique blockchain is at its core, it mandates a level of computer literacy, expertise, and experience – which everyone may be unable to bring to the table.

Cloud Computing in the Financial Sector

Cloud computing uses remote, typically third-party-owned servers to host data, workloads, and applications – essentially leasing computing resources and amenities instead of purchasing and maintaining them yourself. Several modern technology trends, like the rise of SaaS and programmable infrastructure as code (IaC), are thanks to cloud computing.

It has fundamentally altered how financial institutions store and manage data. The cloud offers accessibility, cost-effectiveness, and scalability to organizations of any size. For instance, Stripe, a multinational FinTech corporation, frequently uses the cloud to give organizations a streamlined method of accepting online payments.

At this time, the majority of banks administer customer data and transactions using cloud-based CRM systems. This lets financial institutions maintain a comprehensive record of all consumer interactions across branches – powered by integrations with the central banking system. Besides enabling the prevention and detection of fraud, the cloud also analyzes vast quantities of data from numerous sources. The processing happens on the cloud, reducing costs for the bank.

Banks can fulfill their regulatory compliance obligations using cloud platforms that adhere to the standards and policies of the financial services sector.

A few challenges come with using cloud technology in finance, despite its many benefits – although fewer than AI and blockchain, since the cloud is a significantly more mature technology. Remember, banks are responsible for ensuring the safety and security of their cloud-based data. Some financial institutions are concerned that migrating to the cloud will forfeit ownership of their systems.

Data Analytics: The Game Changer in FinTech

Data analytics is a set of tools, systems, and algorithms that help ingest raw data, transform it for processing, analyze it according to pre-set principles, and visualize the results in tables, reports, or dashboards. It has close synergies with the A of ABCD of FinTech, i.e., artificial intelligence, as AI can power advanced and self-learning analytics.

FinTech companies use data analytics to enhance their services in various ways. Customizing services is one of the most important advantages of data analytics in FinTech. By analyzing consumer behavior data, FinTech companies can develop services and products that are individualized according to the requirements of each customer.

Further, data analysis is used to reduce risk. For example, banking service providers use data analytics to gauge the creditworthiness of prospective borrowers. Through the examination of borrower financial history data, such as income, credit score, and employment status, the lender can ascertain the borrower’s propensity to repay the loan.

Another possible use case for data analytics is the detection of untapped market prospects. By analyzing data on contemporary trends and buyer behavior, FinTech firms can identify market gaps and develop new products and services to address those deficiencies.

The challenge with this technology in FinTech is mainly surrounding infrastructure. The assets and resources needed to control and analyze these massive datasets are crucial – fortunately, cloud computing offers a solution. The other issue is collecting and analyzing data while ensuring privacy, security, and consent.

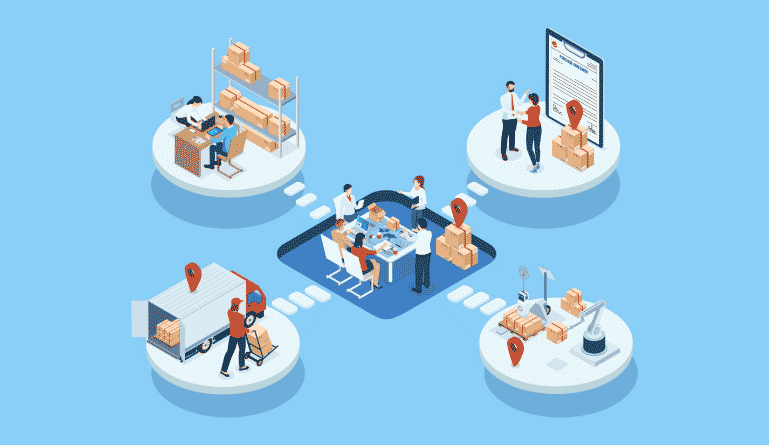

The Synergy of ABCD in FinTech

While these four technologies are powerful in their own right, banks and FinTechs need to explore integrated use cases to garner maximum value from digitization.

Artificial intelligence, for instance, can power data analytics to drive more accurate predictions and forecasts. Blockchain can act as a storehouse for the data used in AI processes, and cloud computing provides the scalable infrastructure needed for these compute-heavy processes. Similarly, blockchain solutions are much more viable when deployed on the cloud.

Modern data analytics tools are also mainly cloud-based, and the lion’s share of data vendors also provide AI solutions, exemplifying the growing overlap between these systems. If incumbent institutions and new-age FinTech banks capitalize on these synergies, they stand to see exponential gains from customer data, existing digital tools, and their process infrastructure.

Closing Thoughts

Artificial intelligence, blockchain, cloud computing, and data analytics are incredible agents of change – for the FinTech sector. In many, they are the proper drivers of alternative finance, enabling expansion and inclusivity. However, their real potential can be realized when implemented in an ecosystem. To build and realize the synergies between these technologies in FinTech, institutions need to pursue digital maturity and take strategic steps toward integration.