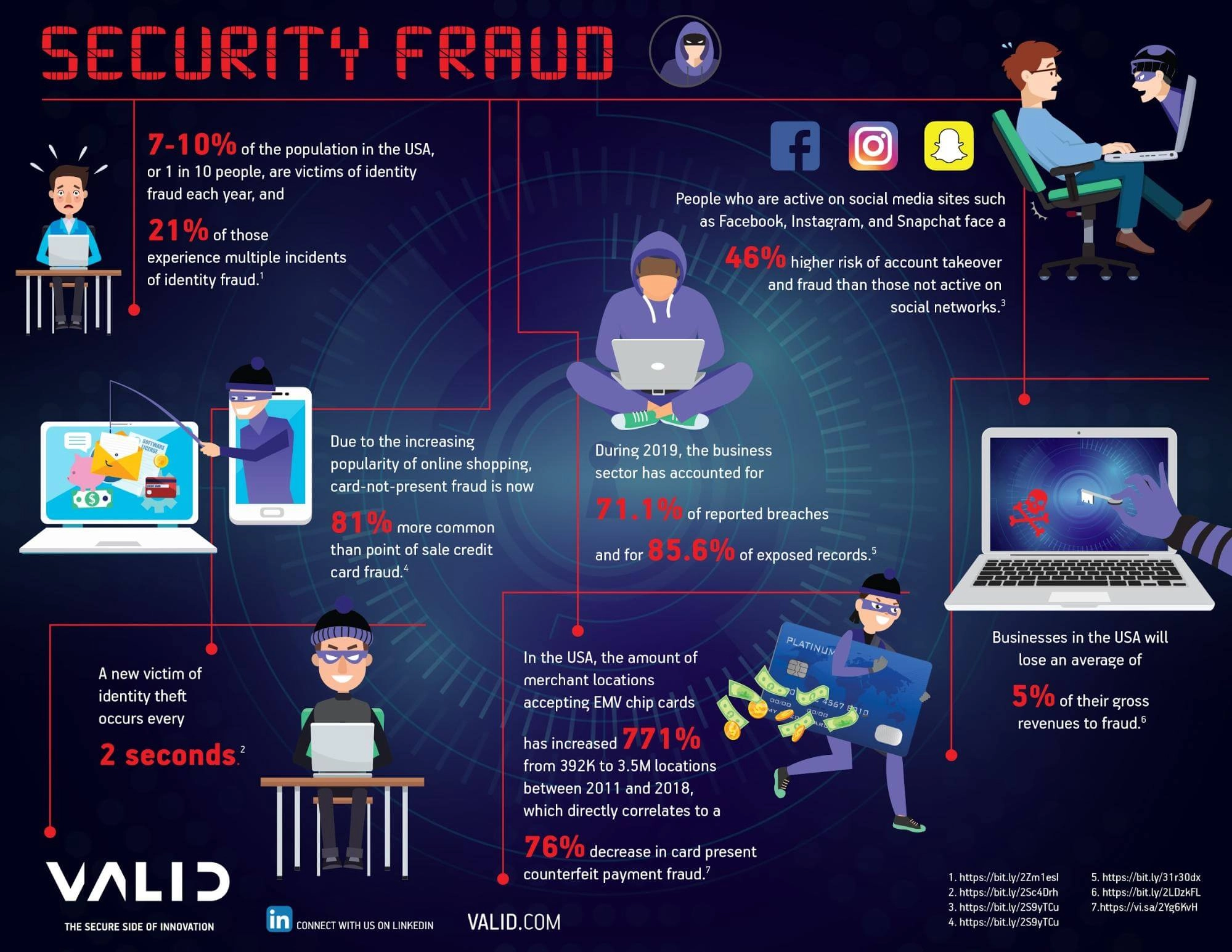

While cybersecurity experts, in cooperation with developers and analysts, are trying to create a perfect system of protection against fraud, the number of victims and successful attempts are only growing. The more actions we do, leaving a trace of the data, the easier it is to collect all the necessary information so that the fraudulent scheme is successful. The infographic below reflect the current picture.

Obviously, the methods of past years have ceased to be effective. Even Fraud Detection with AI and Machine Learning is neither a magic pill nor an absolute guarantee of protection. However, nothing better was invented at the moment, so it makes sense to learn how ML solutions and fraud detection analysis can make your business more secure, and your customers more confident in your services.

What Is Fraud Detection With Machine Learning?

The very concept of detecting fraud using machine learning is based on the idea that legitimate and illegal actions have different characteristics. Moreover, these signs can be completely invisible to the human eye.

The machine learning system for recognizing fraud proceeds from its knowledge of the legitimate operation, compares this knowledge with events occurring in real-time and draws a conclusion about the validity or illegality of a certain action. Here is how it looks.

Fraud Detection – Machine Learning Solution for Business Security

In fact, business security is just the tip of the iceberg. Or a collective term. Machine learning systems can give your business more than you think.

-

Customer Experience Improvement

Machine learning in itself is a very powerful tool for enhancing the user experience. Smart systems learn to understand users based on their actions, predict, customize, and hit the target. And also protect users from fraudulent attempts.

The simplest example is credit card fraud detection. Advanced online banking systems will not allow you to enter the client’s personal account, manage money if your behavior pattern indicates a possible fraud. In this case, improved user experience means the confidence of your users that they are protected from fraudulent attempts as much as possible.

-

Data Protection

According to a Harvard Business Review study, 90% of users surveyed said that the attentive attitude of companies to the personal data of their customers shows a real attitude towards customers. In other words, if you want to win user loyalty, then a careful attitude to data and its comprehensive protection can help.

Machine learning systems are able to track how the data is stored, collected, and used – generally, how much do your procedures comply with GDPR. In the event that potential fraudulent or abnormal actions that treat user data are detected, the system sends an alarm.

-

Elimination of Fraudulent RTO, Promo Code Abuses, and Chargebacks

Fraudsters a priori are smart people, otherwise, they would not be able to come up with schemes that work. As for retail, this is a very attractive industry, since it is always possible to pretend to be a respectable buyer to deceive the seller.

Machine learning systems are able to stop these attempts even at the stage of intent – for example, when users begin to place an order with a suspicious IP, which has already been noticed in fraudulent schemes.

-

Money Losses and Reputation Issues Prevention

Any successful fraudulent attempt means loss of money and reputation. It is much easier to return money than a reputation – this is exactly what you should not risk. Paradoxically, some companies refuse to confront fraud because they are afraid that this will damage their reputation, although, in fact, the opposite is true.

Lacking a fraudulent response strategy damages your reputation the most. And this is the opinion of most modern users.

What Are the Best Practices for Fraud Detection Machine Learning

So, how do machine learning systems work to provide a high level of protection against illegal attacks?

-

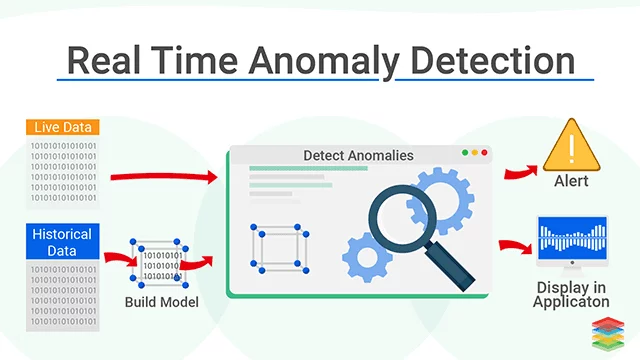

Real-time anomaly detection

Rule-based systems detected fraud when money was already stolen. Modern systems work with constantly changing data in real-time, therefore they are able to catch a fraudulent attempt even at the intention stage. Here’s how it works.

( Also Read: Affiliate Marketing Fraud: How To Prevent It )

-

Behavior analysis

As for user behavior, in this case, the model is trained to recognize typical and abnormal actions for a specific user. An abnormal action with a combination of other factors can be a sign of a fraudulent attempt, for example, if the user withdraws a large amount of cash in another country or city.

-

Deep learning

In this case, it is necessary to develop a neural network, and also have a very large amount of data for analysis.

What Types of Fraud Scenarios Can Be Covered With AIML FD?

| E-commerce | Healthcare | Banking |

|---|---|---|

We have already said that systems are able to track suspicious IP addresses and actions taken with them in order to notify an authorized person about an online fraud attempt. |

This is the case when the system must monitor the behavior of people responsible for the issuance of prescriptions and drugs, and find invisible cause-effect relationships (for example, the conspiracy of a doctor and pharmacist about fraud with expensive or narcotic drugs). |

Money cannot circulate without control by banks and the state. This means that a system specifically designed to search for patterns similar to money laundering and terrorist financing can significantly help solve these crimes and create a transparent banking system. |

The popularity of mobile shopping has led to the rise of mobile fraud, which takes many forms from the theft of an account to friendly fraud. In this case, the smart algorithm monitors the user’s actions committed from a mobile device and concludes whether the smartphone (or account) is in the hands of the rightful owner. |

This is the most common type of fraud, and recently card-not-present fraud is starting to gain momentum. A real-time fraud detection system can help detect an attempt or even intent before the money is stolen. |

In this case, the system collects data about the potential borrower and makes a conclusion about the riskiness of issuing a loan. |

Medical data is very expensive on the black market, and medical organizations must protect it as responsibly as the lives of their patients. A machine learning system is able to identify and block hacking attempts. |

How Much Does It Cost to Implement an ML Fraud Detection Solution?

In fact, it is possible to make a rough estimate of the cost of such a solution only after a very thorough analysis of the business and its needs.

-

Switching/Integration cost

In a case of switching to custom AI solution specifically developed for your business, it may cost from $6000 on average and higher. If you want to integrate a third-party ML software into your business, it may cost you $40000 per year as the highest point.

-

DataSets to implement

According to Ravelin’s research, “Machine learning is not a silver bullet for fraud prevention. It takes a significant amount of data for machine learning models to become accurate. For some merchants, it is useful to apply a basic set of initial rules and allow the models to ‘warm-up’ with more data”.

In other words, insufficient data can be a serious limitation on the introduction of machine learning. On the other hand, the more data needs to be involved, the more expensive and technically complex the solution for your business becomes.

Conclusion

Machine learning opportunities for businesses are not limited to the ability to detect fraud. Machine learning and artificial intelligence are about more enjoyable user experience, useful data-based insights, and a more optimized and ethical business as well. This is just what should be implemented in business processes in the near future.

***

Helen Kovalenko is an IT Project Manager who works on a Data Science team on NLP, Computer Vision and Fraud Detection. Connect with Helen on LinkedIn.