Historically, large financial institutions have opposed the cloud due to concerns about data location and antiquated ideas about poor performance.

This unwillingness and anxiety are now no longer widespread. This is particularly significant given that most government agencies – globally and in all their avatars – are moving toward cloud adoption, and policymakers have become more optimistic about using cloud computing in financial services.

Findings from Flexera’s “2023 State of the Cloud Report” suggest that one-third of financial services firms plan on employing a combination of premises and cloud/software-as-a-service (SaaS) for their enterprise financial data. Over 44% of financial services firms store their data in the cloud, with that percentage expected to increase to 52% over the next year.

In this context, Microsoft’s 2021-launched Industry Cloud for Financial Services provides large banks and non-banking firms with a genuine opportunity to compete against digitally native fintechs and build solid financial technology stacks of their own.

Unpacking the Microsoft Cloud for Financial Services

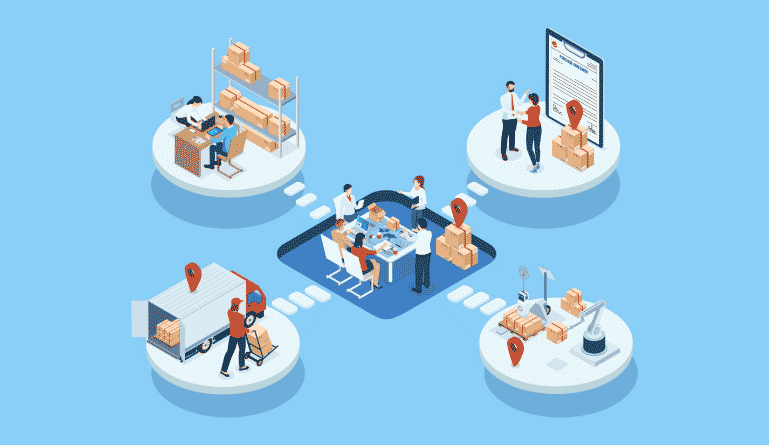

Microsoft Cloud for Financial Services is an integrated suite of cloud functions to handle large-scale financial data.

It is built on the company’s existing services, such as Azure for cloud storage, Dynamics 365 for customer relationship management, GitHub for collaboration, Microsoft 365 for communication and productivity, the Power platform for business intelligence, and Teams for unified employee experiences.

The key difference is that all these services are available through one plan and with tailored tools for companies looking to leverage financial technology.

For instance, the service includes solutions for banking customer insights, engagement, customer onboarding, and loan manager capabilities. The cloud platform’s ‘Loan Manager’ feature facilitates automation and collaboration between the front and back offices.

Many such unique technology enablers are designed only for the financial services industry. Pricing for the solution starts at $20k per tenant per month, available in English and French, with additional support for Dutch, German, Italian, and Spanish.

What Are the Features of Microsoft Cloud for Financial Services?

As mentioned, solution users can expect the same tried-and-tested tools as in Microsoft’s larger portfolio. Specific financial technology capabilities include:

- Unified customer profile: A complete view of a client’s financial standing, which includes behavioral and socioeconomic data

- Customer onboarding: Loan application access and tools for self-service

- Collaboration manager: Organization-wide collaboration, efficiency, and workflow orchestration.

- Banking customer engagement: Utilizing a financial viewpoint of customers to interact with them on their preferred method of communication – with a focus on smart, tech-savvy interactions.

- Account protection: Anti-fraud capabilities to safeguard your company, its customers, and, ultimately, the financial bottom line.

- Purchase protection: Sophisticated adaptive AI that minimizes false positives to fight online purchase fraud.

- Risk assurance and support: Detailed global compliance evaluations and expert responses to queries on regulatory changes.

- Regulatory compliance assessments: Risk inventories, streamlined controls, and compliance with regulations and licenses.

- Retail banking model: A pre-built industry model and data connectors intended to expedite insights.

- Wealth management data model: A model created as an additional layer on top of the retail banking data framework that incorporates key client information, like financial goals and portfolio-linked investment assets.

- Property and casualty insurance data model: A thorough data model that supports an extensive spectrum of use cases, including plans, coverages, claims, and other entities associated with clients and agencies.

- Small business extension data model: Information on individuals, including the ability to merge or interconnect accounts linked to small businesses and associated monetary assets.

- Intelligent appointments: The ability to schedule meetings via the customer’s preferred platform or in person.

- Customer intelligence: AI models that combine demographic data, financial metrics, attitudes, and financial instruments.

Benefits of Microsoft Cloud for Financial Services

Financial technology, in general, brings massive benefits to large institutions by allowing them to exploit their decades of operational intelligence and market legacy. This industry-specific Microsoft Cloud smoothens this journey by allowing you to:

-

Achieve greater interoperability.

Industry clouds are designed for interoperability, which ranks as one of their most significant advantages. In other words, it is compatible with recognized data protocols, prominent loan origination structures, core banking systems, etc., in the financial services industry. Greater interoperability fosters automation and reduces your time and effort by a significant proportion.

-

Benefit from an existing partner network.

The platform will introduce a network of allies and partnerships with years of experience in the financial services industry. In addition to being built for particular fintech use cases, these solutions are also preset to work with the cloud. By using these systems, you can minimize the expenses and challenges related to vendor management.

-

Quickly automate collaboration and productivity workflows.

As stated earlier, financial services cloud systems are significantly more automation-ready than standard cloud solutions. It exists in a single hosting location, is administered by a single vendor, and is built following a uniform set of guidelines and frameworks. Consequently, you can link workflows and processes across the entire financial value chain.

-

Unlock more accurate analytics.

Data unification is a further advantage of having your records and processes exist on a single platform. This strengthens your analytical capabilities and ensures your reports, dashboards, projections, and data structures can use information from various sources. This is easier because all sources are automatically connected to the platform.

-

Discover detailed and comprehensive market insights.

The platform will be continually regularly updated with fresh, market-specific data. In the United States, the United Kingdom, and Australia, Microsoft, for instance, is evaluating its real estate data model with semantic databases featuring policies, claims, etc. Owing to an industry-specific cloud platform, you can tap into the latest market intelligence.

-

Accelerate cloud-ification while maintaining security.

With immediate access to Microsoft’s compliance and engineering professionals, you can speed up global and regional implementations. The platform’s compliance framework aligns Microsoft and associate ecosystems to an established set of criteria. This optimizes primary/first-contact vendor due diligence and evaluates enterprise application readiness, which is a must-have for any financial technology.

Financial Service Industry Cloud is More than the Sum of its Parts

Microsoft launched the Microsoft Cloud for Healthcare in 2020, which was the inaugural edition of what was to be an expanding portfolio of Industry Cloud offerings. 7 Microsoft Industry Clouds existed by the end of 2022, with more anticipated in the future in the coming years and months.

The solution is built upon Azure, Microsoft 365, Dynamics 365, Power Platform, and other Microsoft applications and services. It combines industry-specific components and standards with standard data models, cross-cloud interfaces, process workflows, and APIs.

As a result, companies can assign front-end productivity duties to back-end data management and massively increase the returns from cloud investments.

On top of this, Microsoft’s recent launch of its generative AI assistant, Copilot, is another reason to leverage the cloud. Copilot integrates directly with apps to help remove the drudgery of work data and process-oriented work. Executives may direct Copilot to summarize a customer description, compose documents, and evaluate data in a spreadsheet using natural language processing.

How to Get Started with Microsoft Cloud for Financial Services?

Microsoft Cloud for Financial Services consists of solutions constructed on Dynamics 365 and Microsoft 365, along with Microsoft Power Platform capabilities. You must have licenses for these platforms if you want to use these new features.

Microsoft Cloud Solution Center is a centralized location for installing and configuring these solutions. You can deploy and configure all Microsoft solutions, which include those offered by Microsoft Cloud for Financial Services.

Fortunately, this is a simple process. When you check in to the Solution Center, you’ll see the Microsoft Cloud for Financial Services features accessible to you.

Select the desired features, then choose the solutions you want to deploy. You will either be redirected to a portal where you can acquire and install the solution, or the Solution Center will walk you through the deployment. And that’s it!

It is this simplicity of concept and execution that makes Microsoft’s offering a compelling solution for financial institutions. With fintech’s rise, large institutions must explore and embrace the power of technology to stay caught up. The Microsoft Cloud for Financial Services provides a suitable gateway onto this path.

Next, read about the hybrid cloud and its potential to transform financial services.