IFRS 16 is a new standard affecting all companies within nearly every industry.

IFRS 16 is going into effect soon, so it is essential that CFOs understand this new standard and apply the necessary changes to their company’s finances.

What is IFRS 16 standard?

Well, IFRS 16 summary is that the new International Financial Reporting Standard will require lessors to classify leases as either an ‘operating lease’ or a ‘financing lease.’ Simply, this means that with the new standard, finance leases must be recognized as assets and operating leases must be recognized as expenses. The IFRS 16 effective date is January 1st of 2019, even though it was issued in January of 2016. With three years to prepare, there is no reason for any company to not be compliant by January of next year.

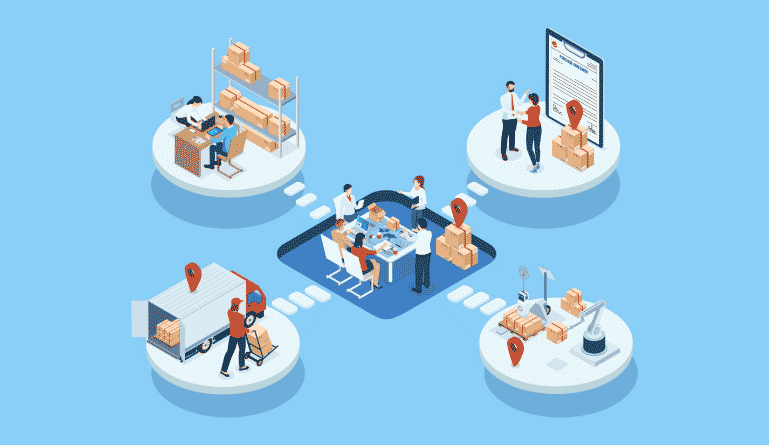

The new international financial reporting standard 16 will affect all sectors and industries, with companies that lease numerous or have high-value leases being affected the most. This will include retail, hotel, bank and telecommunications companies. Companies in the logistics and transport sectors will also be greatly affected. With this new standard going into effect soon, it is essential for CFOs to understand the new guidelines and abide by them.

IFRS 16 Guidelines Every CFO Should Know

With the new IFRS 16 standard, all leases must be recognized on the balance sheet. This is different from before when operating leases did not have to be added to the balance sheet. Before this new standard was issued, assets nor liability needed to be recognized by CFOs. With this new standard, though, a right-of-use asset and a respective lease liability will need to be recognized for every lease contract in the future.

In accordance with this new standard, the IASB has introduced additional elements that must be taken into consideration. These new elements the IASB has added are to ensure that the liability isn’t understated on the balance sheet. The main goal of these additional elements is to reflect the economic substance of the arrangement by taking all cash flows associated with the leasing arrangement into account. This forces all residual guarantees to be taken explicitly into consideration. With this new standard, variable payments that depend on an index or rate should be included in lease liability or asset, based upon the index or rate on the commencement date. These are the only variable payments that need to be included, though, as other variable payments are excluded from liability or asset.

Under the new IFRS 16, companies will now be required to recalculate their obligations and adjust financial statements accordingly if they wish to change the period over which they will lease the asset. For companies that have hundreds of lease contracts, this could be very time-consuming. For this reason, it is very beneficial for those companies to invest in financial software that will allow them to achieve these changes in an efficient amount of time with minimal or no errors.

With IFRS 16, there will no longer be recognition of rent expense in income statements. With the interaction of effective interest being used to reduce the recognized financial liability and the depreciation of the ‘right to use’ asset, lessees rent expense will now be front-end loaded. When this new standard comes into effect, interest and depreciation will replace rent expense, causing operation cash flows to increase.

As 2018 moves closer to the date when IFRS 16 will go into effect, it is strongly recommended by many experts that companies take some time to assess the impact these new accounting changes will have on their business. It is best to adopt this new standard in your company as soon as possible because it has the potential to significantly reshape the future of your financial statements.