Introduction

The year 2024 marks a pivotal moment for the global semiconductor industry. Driven by the explosive growth of artificial intelligence (AI), landmark U.S. policy initiatives, and unprecedented private sector investment, the sector is navigating both extraordinary opportunities and daunting challenges. This analysis synthesizes insights from the 2024 SIA State of the U.S. Semiconductor Industry Report and leading research, exploring how AI, government action, and industry innovation are reshaping the semiconductor landscape.

1. The AI Boom: Catalyst for Semiconductor Demand

Artificial intelligence is now the single most important driver of semiconductor demand. The proliferation of generative AI, large language models (LLMs), and AI-powered applications across sectors—from healthcare and finance to manufacturing and defense—has pushed chipmakers to the center of global technological progress.

AI’s Insatiable Appetite for Compute

AI models, especially LLMs like OpenAI’s GPT-4 and Google’s Gemini, require massive computational resources. Training a single state-of-the-art model can consume thousands of high-performance GPUs, each containing billions of transistors. This has led to:

- Record-breaking chip sales: In 2023, nearly 1 trillion semiconductors were sold globally, with the market rebounding to $527 billion after a brief downturn (SIA, 2024, p. 4).

- Accelerated innovation cycles: Companies like NVIDIA, AMD, and Intel are releasing new AI-optimized chips on an annual basis, with NVIDIA’s Blackwell and Hopper architectures setting new benchmarks for AI inference and training (NVIDIA Q3 FY2024 Earnings).

- Demand for advanced manufacturing: Cutting-edge AI chips are now manufactured at process nodes below 10 nanometers, requiring the world’s most advanced fabrication technologies.

The Feedback Loop: AI Fuels Chip Innovation, and Vice Versa

AI is not just consuming chips—it is also transforming how chips are designed. AI-driven electronic design automation (EDA) tools are shortening design cycles, optimizing layouts, and even discovering novel architectures, creating a virtuous cycle of innovation (Nature Electronics, 2023).

Figure: Tracking the Chips Act: Semiconductor Manufacturing Investments (May 2020–Aug 2024)

2. U.S. Policy: The CHIPS Act and Its Ripple Effects

Recognizing the strategic importance of semiconductors, the United States enacted the CHIPS and Science Act, unleashing more than $50 billion in federal incentives for domestic chip manufacturing, R&D, and workforce development.

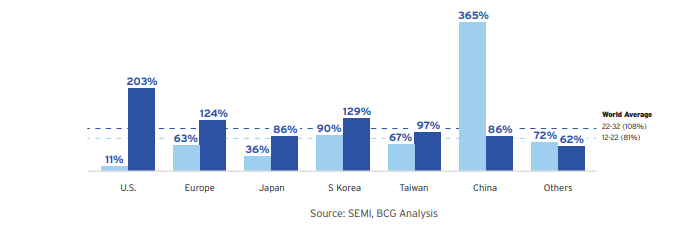

Figure: Shifting Silicon: Regional WSPM Capacity Growth Trends (2012–2022 vs. 2022–2032)

Investment Surge and Capacity Expansion

- $450 Billion in Private Investment: Since the CHIPS Act’s introduction, over 90 new semiconductor manufacturing projects have been announced in 28 states, totaling nearly $450 billion in private investment (SIA, 2024, p. 8).

- Capacity Tripling: U.S. fab capacity is projected to increase by 203% from 2022 to 2032, the highest growth rate globally (SIA, 2024, p. 10).

- Advanced Node Leadership: By 2032, the U.S. is forecast to capture 28% of global advanced (sub-10nm) chip manufacturing capacity, up from 10% today.

R&D and Workforce Development

- $13 Billion for R&D: The CHIPS Act allocates $13 billion for research, including the National Semiconductor Technology Center (NSTC), advanced packaging initiatives, and digital twin manufacturing programs (SIA, 2024, p. 9).

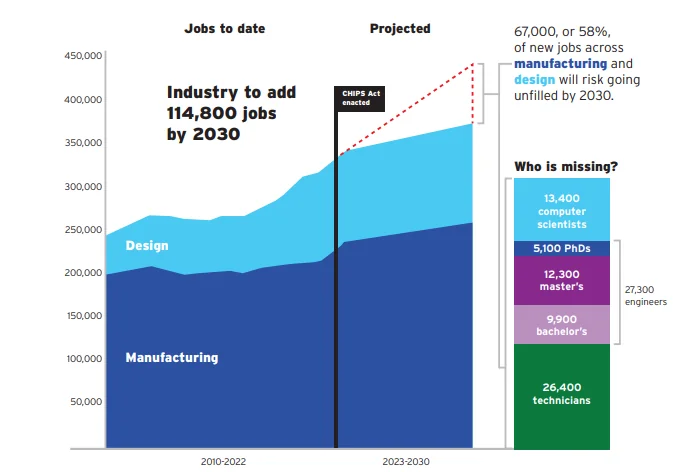

- Talent Pipeline: Despite the boom, the U.S. faces a projected shortfall of 67,000 semiconductor technicians, engineers, and computer scientists by 2030. Addressing this gap is critical for sustaining growth (SIA, 2024, p. 13).

Figure: Bridging the Semiconductor Talent Divide

Policy Challenges and Recommendations

While the CHIPS Act has sparked a renaissance in U.S. chipmaking, the report warns of persistent challenges:

- Expiration of incentives: The advanced manufacturing investment credit is set to expire in 2026, threatening long-term investment.

- Need for design incentives: Expanding tax credits to include chip design is vital for end-to-end leadership.

- Global market access: U.S. competitiveness depends on open access to overseas markets for American-made chips.

3. Global Supply Chain: Resilience, Risk, and Regionalization

Strengthening the U.S. and Global Supply Chain

With semiconductors underpinning virtually every modern technology, supply chain resilience has become a national security imperative. The COVID-19 pandemic and geopolitical tensions exposed vulnerabilities, prompting governments and industry to diversify and localize production.

- Reshoring and Nearshoring: The U.S. is projected to grow its share of global fab capacity from 10% to 14% by 2032, reversing decades of decline (SIA, 2024, p. 10).

- Global Investment: China, Taiwan, South Korea, and Europe are also ramping up investments, with China expected to see a 365% increase in fab capacity by 2032.

Vulnerabilities and Ongoing Risks

Despite progress, the ecosystem remains exposed to:

- Geopolitical flashpoints: Taiwan and South Korea dominate advanced chip manufacturing, making the industry vulnerable to regional instability (CSIS, 2023).

- Materials and equipment bottlenecks: Critical materials (e.g., rare earths, photoresists) and advanced lithography equipment are concentrated in a handful of countries.

- Talent shortages: The global race for semiconductor talent is intensifying, with Europe and Asia also facing skills gaps.

4. Sustainability and the Green Transition

Semiconductor manufacturing is resource-intensive, consuming significant water, energy, and chemicals. As demand grows, so does the industry’s environmental footprint.

Industry Initiatives

- Green fabs: Leading companies are investing in water recycling, renewable energy, and waste reduction. For example, Intel and TSMC have set ambitious targets for carbon neutrality (Intel Sustainability Report 2023).

- Eco-friendly chip design: New AI chips are being designed for greater energy efficiency, reducing the carbon footprint of data centers and edge devices.

Regulatory and Market Pressures

- ESG requirements: Investors and regulators are demanding transparency and progress on environmental, social, and governance (ESG) metrics.

- Circular economy: There is growing momentum for recycling and reusing semiconductor materials, reducing e-waste and supply chain risk.

5. The Workforce Challenge: Bridging the Gap

The semiconductor industry’s future hinges on its ability to attract, train, and retain top talent.

The Talent Gap

- 67,000 unfilled jobs by 2030: The U.S. faces a looming shortfall of technicians, engineers, and computer scientists (SIA, 2024, p. 13).

- Global competition: The U.S., Europe, and Asia are all competing for the same pool of highly skilled workers.

Solutions and Strategies

- STEM education: Expanding STEM programs at all levels, from K-12 to university, is critical.

- Apprenticeships and retraining: Industry and government are launching new programs to reskill workers and create pathways into semiconductor careers.

- Immigration reform: Attracting global talent is essential for filling high-skill roles.

6. AI’s Transformative Impact on Chip Design and Manufacturing

AI is not just a consumer of chips—it is revolutionizing how chips are designed, tested, and manufactured.

AI-Driven Design Automation

- EDA with AI: Tools like Synopsys DSO.ai and Cadence Cerebrus use AI to optimize chip layouts, reduce power consumption, and accelerate time-to-market (Synopsys, 2023).

- Generative AI for verification: AI models are being used to automatically generate test cases and identify design flaws, improving reliability and reducing costs.

Smart Manufacturing

- Predictive maintenance: AI-powered sensors and analytics predict equipment failures before they happen, minimizing downtime.

- Yield optimization: Machine learning algorithms analyze manufacturing data to maximize yields and identify process improvements.

7. Geopolitics: The New Chip Wars

Semiconductors are now at the heart of global strategic competition.

U.S.-China Rivalry

- Export controls: The U.S. has imposed sweeping restrictions on advanced chip exports to China, aiming to slow Beijing’s technological ascent (Reuters, 2023).

- Decoupling risks: Both countries are investing heavily in domestic capacity, raising fears of a fragmented global supply chain.

Allies and Partnerships

- CHIP alliances: The U.S., Japan, South Korea, and the EU are deepening cooperation on R&D, standards, and supply chain security (European Commission, 2024).

- “Friendshoring”: Relocating supply chains to trusted partners is seen as a way to reduce geopolitical risk.

8. The Road Ahead: Opportunities and Uncertainties

Opportunities

- AI-driven innovation: The synergy between AI and semiconductors will unlock new applications in healthcare, energy, mobility, and more.

- Resilient supply chains: Diversification and investment will make the industry more robust against shocks.

- Sustainable growth: Green manufacturing and circular economy initiatives will align the industry with global climate goals.

Uncertainties

- Policy continuity: The expiration of key incentives could slow investment.

- Global fragmentation: Geopolitical tensions may lead to incompatible standards and duplicated supply chains.

- Talent bottlenecks: Without aggressive action, workforce shortages could constrain growth.

Conclusion

The semiconductor industry in 2024 stands at a crossroads. Propelled by AI, fortified by policy, and energized by private investment, it is poised for a decade of extraordinary growth and innovation. Yet, the sector faces formidable challenges—from supply chain vulnerabilities and environmental pressures to a critical shortage of skilled workers.

Success will depend on sustained public and private collaboration, a relentless focus on innovation, and a commitment to building a diverse and resilient workforce. As semiconductors become ever more central to the global economy and national security, the stakes have never been higher.