The past months have been a trying time due to the pandemic. Almost everyone’s prioritizing social distancing to safeguard the health of colleagues, family, and dear ones. And so, for working professionals, working from home has become the “new normal.”

As employees switch to remote working rapidly, companies are trying to keep their workforce operational by providing the needed support. This support can be in the form of helping employees set up their home office or/and reimbursing employees for expenses incurred for business while working from home. As the nature of business-related expenses changes, companies need to reevaluate their current expense management policies and system.

For example, pre-COVID-19, the task of reimbursing employees could somehow be done using paper and spreadsheet-based processes, though tedious and consuming. But now, with the pandemic and the new working condition, the process has become more tedious. Due to the current crises and uncertainty, it may be time for organizations to consider automating their expense management process.

With many industries coming into the spotlight due to the sheer innovation-driven technology they hold, expense management isn’t far behind. This article talks about how modern automated expense management software are playing their bit in helping businesses carry on as usual.

The New Normal and the Changes it Brings

Before the Coronavirus crisis, there was no mandatory work-from-home policy for employees. Employers were also not expected to reimburse employees for work-from-home-related expenses. But now, companies may need to set up a process to reimburse employees for the new type of expenses.

On shifting their office to their home, to keep the business operations running, employees are expected to incur expenses. These expenses may include high-speed internet set-up, cell phone charges, telecommunication hardware and software, HDMI cables, headphones, and other equipment needed for the job.

As work-from-home related purchases increase, companies are needing to update and rewrite their expense policies. Companies have to note changes and requirements and establish reasonable and legally compliant expense policies.

Some of the guidelines the Finance team can address in the new expense policy are:

- Reimbursement route. For, e.g., whether a business-related expense require additional/advance approval from a manager or supervisor

- A reasonable period for employees to submit their expense reports

- Limits of reimbursement amount for different categories

- List of reimbursable and non-reimbursable items

- Documents that employees need to provide and more.

In addition to defining a new expense policy, companies also have to analyze their spending. Because as economic uncertainty unravels, companies have to prepare to cut down costs wherever they can.

This leads us to the question: Can your company’s current expense management process ensure visibility and compliance at the same time?

Implementing new changes is difficult, but if a company relies on manual expense management processes, it can pose many unexpected challenges. This is why companies have to assess both the present and future capabilities of their system.

How Can Automating the Expense Management Process Help During a Crisis?

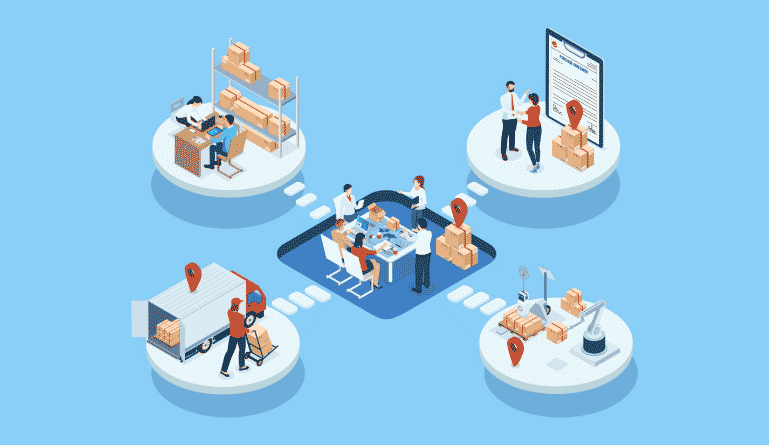

With manual processes, employers face problems with visibility, compliance, spend management, and streamlining workflow. But turning to automation software can be a game-changer for organizations.

According to a Deloitte global survey, organizations adopting automation have seen a significant increase in compliance (92%), accuracy (90%), productivity (86%), and reduction in cost (59%).

There’s no doubt that companies utilizing automation can take care of mundane, repetitive, and error-prone tasks for employees. This, in turn, can help companies cut down costs significantly and boost revenue as well as employee’s efficiency. In addition to saving time and money, it can help the Finance team manage expenses and cash flows and stay on top of costs.

Automate Employee Expense Approval Workflow

The expense approval process may seem pretty straightforward, but the manual expense management process can face additional challenges with remote working in the picture.

On one side, employees have to:

- Keep track of all types of business expenses- e.g., receipt and invoices for internet charges, phone bills, office supplies, etc.

- Sit down and collate work-from-home-related expenses with all the proper documentation

- Send lengthy expense reports for approval before the due date

On the other side, for approvers and managers:

- Receives employees’ expense reports in bulk

- Have to spend a considerable amount of their time reviewing. For e.g., go through each employee’s expense reports and ensure it does not violate any company expense policy.

- Ensure they send all the employee expense details to the Finance team on-time

For the finance team, they have to:

- Ensure new expenses are compliant with the new policy

- Ensure no policy violations or expense fraud slips by. Manually go through every line of expense reports and ensure it matches the receipts

- Reimburse employees promptly

- Make sure they have visibility into company spends and financial standing.

But when companies choose to automate their reimbursement process with expense management software, it tells a different story.

For employees:

- They can submit expense reports in real-time from the comfort of their homes

- They can upload supporting documents along with their expense reports

- With auto-routing, after submitting their expense report, it is routed to the right person for approval

For approvers and managers:

- With employee reporting their expenses in real-time, they do not have to worry about dealing with a huge pile of expense reports at the end of the month

- Thanks to clouding storage, they can access all the employee’s expense report anytime, even though their phone

- They can review reports right from their mobile

For the finance team:

- They can automate the approval process by setting up workflow based on the company hierarchy- single-stage, multi-stage, project-based, cross org, etc. This easily automates and streamlines the entire workflow

- They receive expense reports that comply with the company’s expense policies

- They can easily access expense documents from anywhere, anytime and have greater visibility into company expenses

- The turnaround time for employee reimbursements is cut down drastically

Increase Employee Compliance with Real-Time Policy Check

Expense management is susceptible to expense fraud, such as misusing stipends, overclaiming, duplicate entry, and more if not appropriately managed. But with a new company policy in-place and employees functioning remotely, leaving employees to make their business expenses can be a little daunting for the Finance team.

But with a robust policy engine present in an expense management software, the worries of the Finance team can be put to rest.

With a real-time policy check engine:

- The Finance team can configure all their company policies into the software, no matter how complex it is. They can set up policies based on different parameters- employee levels, departments, expense categories, etc.

- Each employee expense report goes through a thorough audit check and ensures that it falls under company regulations.

- Policy checks are synchronous with expense reporting. This means if the software detects, for example, duplicate receipts, when an employee is filing for reimbursement, it automatically flags the error.

- Employees can resolve policy errors and violations before they submit their expense reports.

Get Visibility into Company Spends

Having visibility into the company’s spending is crucial to control how the company is utilizing its finances. But manually processing and analyzing spend data in a spreadsheet can cause costly errors and missed saving opportunities. Relying on a manual system can also create additional delays if the Finance team has to chase employees for documentation or updates.

But by choosing to use a cloud-based expense management software, the Finance team can gain a bird’s eye view of the entire operation. The cloud technology makes it easy for the Finance team to bring all the company expense data and documentation under one system. The software also offers a digital audit trail so that the Finance team can understand the status of any expense report.

With expense management software, the Finance team can keep track of every expense and avoid delays in payments or duplicate payments. All the expense data are also organized thanks to AI and ML technology present in the software.

This eliminates manual data entry efforts and errors. All corporate credit card expenses can also be reconciled with its transaction statements thanks to automation.

The modern expense management software also offers data analytics that the Finance teams can use to plan better, forecast accurately, and allocate budgets accordingly.

Final Thoughts

As organizations continue to go through this economic uncertainty, they have to implement new changes to keep their workforce moving. The current concern for most companies is supporting their employees while they work-from-home. But organizations must realize that with shifts in employee business expenses, they have to expect different spending risks.

The old manual reimbursement process won’t cut it for companies. Organizations have to look into other modern solutions, such as expense management software to address their expense reporting and management needs.

An automated expense management software can help automate the entire approval workflow to ensure that employee reports comply with the new policy regulations. Additionally, with cloud-technology, employees can upload all expense-related data in a centralized system for the finance teams to access. With the right technology in place, the finance team can address issues faster, focus on areas that need attention, and cut down on unnecessary expenses. This is how expense automation can help your business stay afloat during such testing times.

***

Akhono Seleyi is a Content Marketer from Fyle, an AI expense management software company designed to put an end to your expense reporting and management woes.