The rise of app-based investments has increased over the past 5 years as there are many solutions for investment opportunities available today.

There has been an increase in app-based investment opportunities; this article will discuss the hottest applications around.

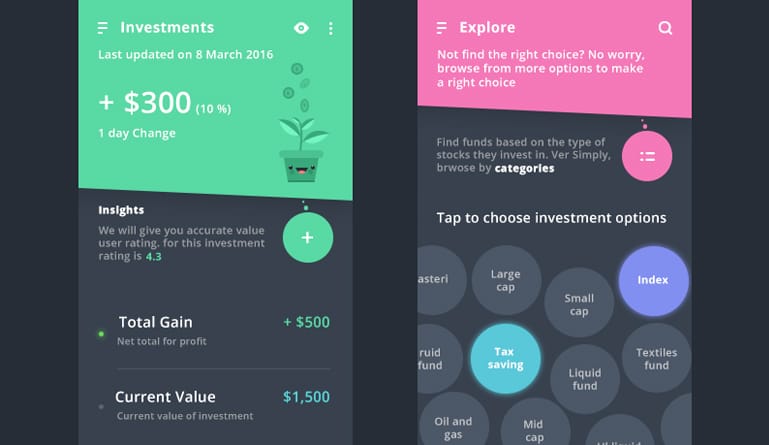

The rise of app-based investing has gone up dramatically in the past 5 years. There are many popular investing applications such as Robinhood, Acorns, and Stash to name a few that create investing opportunities easy for anyone, even if you have no experience at all. The user interface created for these applications is simple and very user based.

One of the biggest reasons why these applications that focus on investing and saving flourished so much currently is Millennials. Applications that focus on investment management and the saving money concept appeal most to Millennials. There are many options available for applications that focus on micro-investing to get started which is why the younger generation are also big contributors towards the platforms that focus essentially on the ‘piggy bank’ aspect. Almost all other major brokerages such as Fidelity, TD Ameritrade, Charles Schwab, E-Trade, and more offer application-based investing access through your phone.

Robinhood is one of the hottest app-based investment brokerages out currently, which allows you to buy and sell stocks/shares for no commission. This has been a game changer in the investment world creating a lot of opportunities for those that don’t have the big bucks and want to start investing. There’s also no minimum amount you must put into Robinhood to start trading.

Since Robinhood is one of the first brokerages to offer commission-free trading, it has created a revolutionary service for investing, making it hard to compete against in certain aspects. Even before Robinhood had officially launched their campaign, there were over one million users signed up for the service before it came to start. Commission-free stock trading changed the game, and eventually, when they added crypto trading options in the mix, it brought even more users to the platform.

Another application that is exploding right now is Stash. This app is also one of the best investment apps to download because it allows you to pick from 40 different ETF funds and stocks, and the minimum deposit amount is only $5. One big reason Stash is different compared to many of these other investment companies is the focus they pose on personal guidance.

Stash coaches people through the investing world by providing personalized challenges. Many millennials have no clue what to do in the stock market, and Stash makes it perfect for them because the service offers unlimited education opportunities. Stash learn provides new articles and tips for everyone using the application to help them create smarter investment decisions, and habits, overall creating a more confident investor.

Lastly, this app-based investment application has over 3 million users and is called Acorns. Acorns has a very different approach compared to the other two investment applications I have mentioned. Acorns rounds up your credit card/debit purchases to the nearest dollar. For instance, if you buy a coffee for $1.50, Acorns will grab the extra .50 cents and allocate it towards your Acorns account and eventually without realizing, you can have yourself a nice investment account in over a month.