Financial technology or fintech is accelerating the positive change in the business industry. All the latest advancements in the business industry are meant to provide a seamless experience to the customers. It is to improve financial services so that clients can manage their finances, avoid overspending and navigate all kinds of risks. In this article, we have given the latest fintech trends in 2021.

From open banking systems to biometric security models, FinTech is here to set the trends and make a dynamic change in the industry. Before diving into the finance-oriented (FinTech) application trends, we will give an overview of what it is.

What is FinTech?

FinTech is short for finance and technology. The finance-oriented application provides advanced yet innovative solutions to improve financial services. The utmost goal is to cater to the users’ needs and help them to manage their finances.

FinTech solutions are widely available and use combinations of biometrics, artificial intelligence, blockchain, and e-commerce.

However, FinTech is not a brand name or software. The word is used collectively for technological advancements and the trends that revolve around it. Therefore, FinTech solutions are used to make one’s business operations efficient.

It consolidates multiple banking software into a full-proof digital ERP solution. Hence, you can use it for suppliers, employees, and customers to make banking faster, safer and easier.

With the help of secure finance-oriented applications, users won’t waste another second on routine tasks. The employees and customers won’t have any problem tracking invoices, receipts, payments, and deposits.

Selling and buying products has become easier than ever, all thanks to FinTech solutions.

Top FinTech Trends to Consider in 2021

We have seen dramatic growth in FinTech during the pandemic. As the banks shut down, people largely relied on virtual financial services. A FinTech solution is so widely acknowledged that 96% of global consumers(1) have reported using it, once in their lifetime. So, what will it take to grow your business?

-

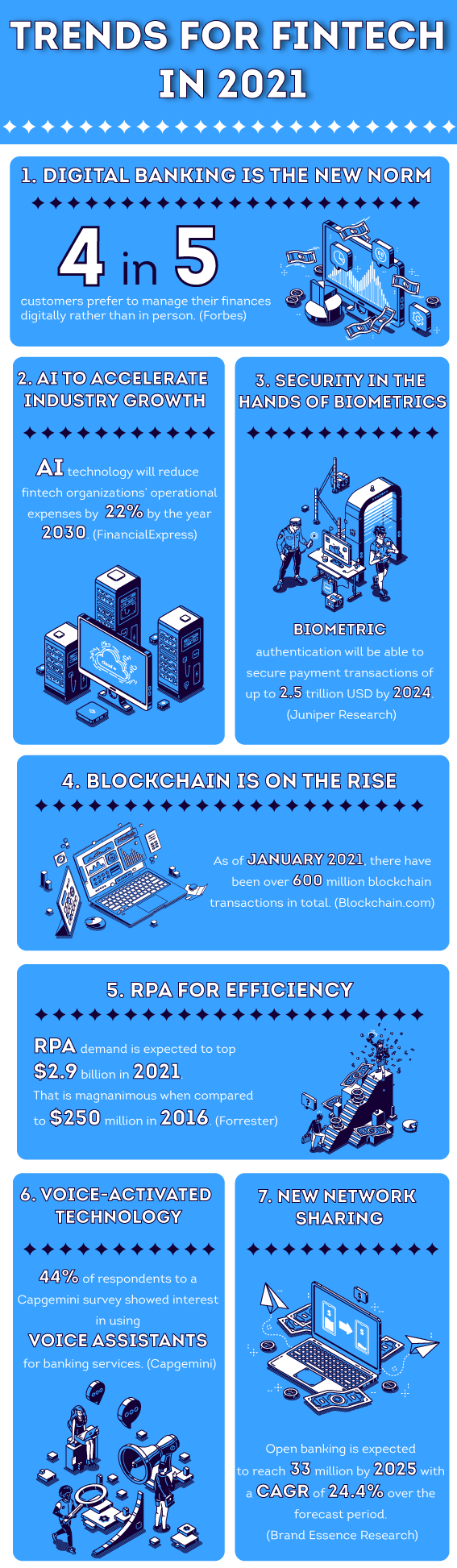

Digital banking will be a new norm

The pandemic has everybody confined to their homes. Therefore, visiting the establishments has plummeted. All thanks to the growth in biometric, artificial intelligence, and cybersecurity, digital banking is easier to access than ever.

Consumers will be able to execute every important task while accessing a huge range of financial information.

As more people will opt for digital banking, there will be a significant decline in paper-based banking. As of 2020, people have become comfortable in accessing financial services through online apps and messaging. -

Biometric security systems will be widely available

Hackers and cybercriminals are more than active now that the whole world is shifted online. Therefore, the FinTech industry will likely come up with advanced safety measures to avoid security breaches.

A biometric security system is the best way to take the customers into confidence and ensure that their data is protected.

Even though biometric sensors that require physical contact are being discouraged due to the circumstances, industry experts will soon come up with contactless biometric security systems.

-

Blockchain technology will make transactions safer

With the cutting-edge technology, blockchain, one can safely do all the transactions. As per an authentic report, 48% of bank representatives think that blockchain technology can make bank transactions safe.

As blockchain works on decentralized networks, there won’t be any government entity or third-party involved. Thus, the data will remain protected.

-

Neobanking 2.0 will decline paper-based banking

Neobanking, also known as internet-only banking operates exclusively, without any help from traditional bank establishments. The term, ‘Neobank’ first became prominent in the year 2017. It was a viable FinTech solution for easing the challenges faced by traditional banks.

As of 2021, Neobanking is widely available and, companies can work either get their license or work with a brick-and-mortar bank to offer their financial services.

-

Artificial Intelligence and machine learning will take over

Banks across the globe are considering integrating their operations with artificial intelligence. As per research, AI will reduce operational expenditures by 22%. Therefore, a bank can save as much as $1 trillion by integrating AI.

Besides, machine learning and AI are being used to identify financial frauds and mitigate cybercrimes.

-

Open Banking will enable data networking across banks

Open baking is somehow related to the second payment services directive (PSD2). This model forces every bank to release data securely so that authorized information can be shared easily on multiple platforms.

All the thought leaders of the industry will utilize open banking. In fact, the total value is expected to reach $43.15 billion(2) by the year 2026.

-

Regulatory technology in banking and financial services

Regulatory technology will enable businesses to use software that will simplify all the compliance processes associated with federal and state laws and regulations.

A regulatory technology solution will be able to perform the following operations:

- Transaction monitoring

- Regulatory reporting

- Identity management

- Risk management tasks

-

Innovative payment options will leave consumers in awe

Innovative payment options are taking over the e-commerce industry. We have seen mobile wallets, mobile payments, contactless payments, AI for security, ID verification tech, and smart speaker system.

Mobile payments are already surging and will react at 760 billion by 2020. Also, mobile wallets will partially replace physical wallets. A mobile wallet has everything’ from your credit cards to discount vouchers.

-

Autonomous finance will reshape the banking industry

Autonomous finance apps will reshape the way consumers interact with money online. Technically, the term revolves around self-driving funds. Autonomous financing apps will guide consumers on where to make investments and manage risks.

Moreover, it will be beneficial for the banks as well. The technology will be able to approve loans and set considerable interest rates. In short, autonomous finance apps use machine learning and AI to manage a user’s money.

-

Increase in financial inclusion

Financial technology has initiated solutions like mobile money and agency banking to improve financial inclusion(3) in many regions of the world. In the year 2021, FinTech apps will be able to provide all types of banking services to the illiterate among us.

-

Robotic process automation will automate routine tasks

RPA uses digital workers or robots to automate routine tasks. FinTech has already implemented the RPA tech to improve productivity and overall workplace efficiency. Moreover, it also cuts down the operational costs.

-

Voice-activated technologies

Nowadays, voice assistants provide an excellent experience when one has a query. Voice-activated tech is powered by AI and is set to improve the customer experience in the banking sector. As of now, voice assistance can do the following tasks:

- Set up recurring payments

- Replying to typical questions

- Provide basic financial info

- Direct customers to the right place on a website

- Categorize customer calls

In the future, voice assistants will also be able to use a client’s biometric data to authorize payments. However, new security breaches will emerge and threaten a bank’s safety measures.

Final Thoughts

All the FinTech trends we have discussed were emerged due to the consumers’ needs. FinTech apps offer better financial services. However, it is still progressing so that the illiterate section of the society could access safe financial services as well.