by Brad Bailey, Capital Markets Research Director, Celent

What will the future of cross-asset trading solutions look like?

The answer isn’t simple. What form the cross-asset solutions(1) will take in their end state is yet to be determined. But now—with the adoption of cross-asset trading technology on the rise in some asset classes and stages of the trade lifecycle on the sell-side is the time to address the interest in this space.

Today’s COVID-19 crisis highlights the imperative to better meet clients’ needs through automated services, tailored to specific segments. If sell-side front office silos are extreme, or if the technology isn’t adequate, achieving these goals can be particularly challenging.

The Trajectory

Electronic trading is growing in prominence, across asset classes (though at varying speeds). E-trading’s growth over the past decade spurred sell-side institutions to develop electronic capabilities, but these were largely housed within asset classes or product silos. Factors like differences between asset classes, legacy technology stacks, or verticals within banks stood as impediments to adopting cross-asset technology more broadly or with significant speed.

The current sell-side ecosystem is shifting from bespoke front office technology (for specific asset classes or products) to cross- or multi-asset trading technology. Well-publicized recent cross-asset electronic moves include the cross-asset execution and platform division announced by UBS in October 2019 and Citi’s May 2020 announcement that it is developing an end-to-end digital strategy and execution plan for its electronic factors.

Among the factors driving the interest in multi-asset platform are the market structure, with continued growth in electronic trading and evolution of execution protocols (both order-driven and quote-driven); the economics of sustained cost pressure to reduce spend and complexity associated with e-trading; clients’ demand for insights and innovative offerings in areas like portfolio trading; growing interest in the insights available from giant data sets; and increased transparency to meet risk and regulatory requirements.

The Vendor Landscape

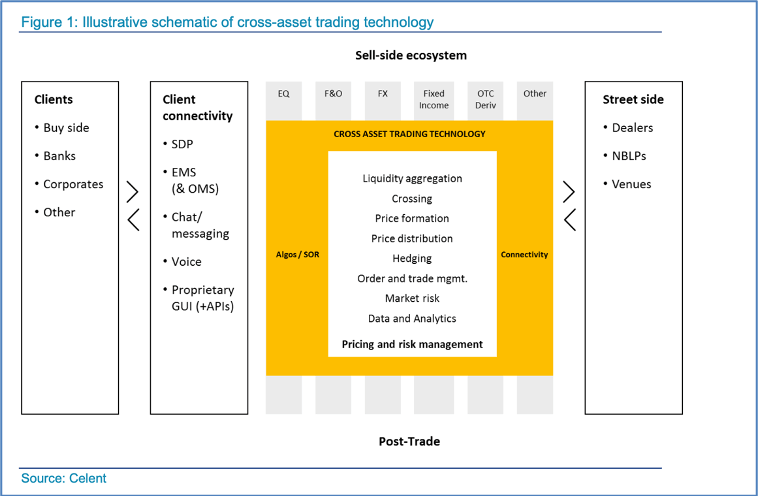

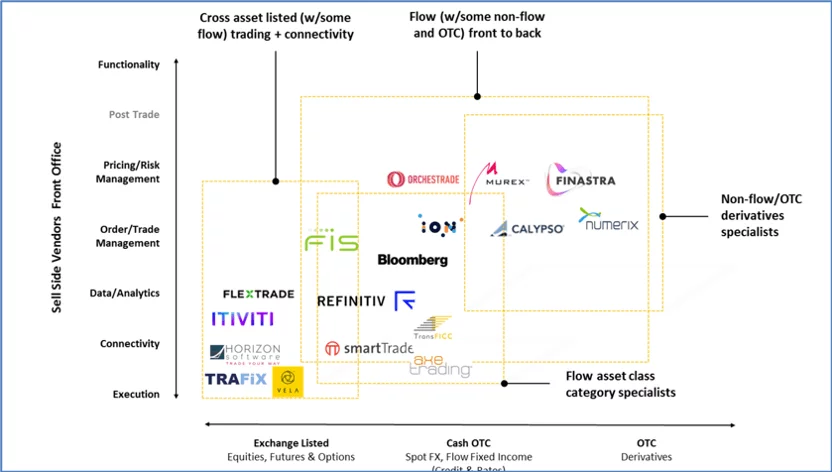

The sell-side vendor landscape (as illustrated in the vendor map below) includes large and smaller vendors that offer a range of options, from asset class-specific providers to broad-based providers and other emerging providers. Functionalities include connectivity, data/analytics, execution, order/trade management, post-trade, and pricing/risk management.

Some sell-side technology firms have built their cross-asset offerings through acquisition, often expanding first to related asset classes (e.g. moving from US equities to EMEA equities) or expanding to the derivative of an underlying cash instrument that vender already covers. Organic growth may pose challenges, though, when vendors attempt to expand across asset classes or to different parts of the value chain.

Vendors are consolidating assets in order to broaden offerings. The rolled-up firms may be packaged into one solution or a similar technology stack; alternately, the acquired firms may continue to function as separate entities.

Vendors that will be highly effective will take an open ecosystem approach, facilitating access and integrating tools and data from outside their ecosystems; provide a consistent architectural framework that presents a unified front office technology stack across asset classes, allowing for a clear understanding of overall exposures and insights, while lowering costs of tech development and maintenance; and develop modular solutions that integrate proprietary development and vendor solutions.

As vendors develop next-gen, cross-asset business and technology, those that provide banks with capabilities (such as transaction cost analysis, execution algos, and client and venue connectivity) across a range of asset classes will be well-positioned.

( Also Read: What to Know Before Investing in Business? )

The Road Ahead

To move beyond the limitations and to maintain electronic services across more asset classes and with more capabilities, sell-side institutions must carefully consider:

-

Strengths:

What unique strengths inform an institution’s e-trading value proposition and go-to-market strategy? What differentiation does cross-asset trading provide?

-

Target clients

Who are the target clients for e-trading? What are the needs of clients in each segment? Can cross-asset trading capabilities improve client services or unmet needs?

-

Technology stack

What’s the existing state of an institution’s stack? Consider if the cost and complexity of either adopting or developing new cross-asset trading technology will yield a suitable payoff—and if the institution is able to appropriately prioritize the initiative.

-

Market structures

What differences in market structures may limit the ability to trade across asset classes (e.g. credit and futures) without sacrificing accuracy, for example?

The pace of cross-asset technology on the sell-side is sure to vary, but dealers are clearly taking steps to build and maintain electronic services across a growing set of asset classes and capabilities.

***

Brad J. Bailey is the Capital Markets Research Director at Celent, based in the firm’s New York office. He is an expert in electronic trading and market structure across asset classes and is a recognized thought leader in emerging front office technology, data analytics, and capital markets fintech.