Open banking and PSD2 went into effect in January, and gave bank customers more freedom and protection when interacting with banks, third-party financial services providers and other members of the payment ecosystem. These new regulations offer more seamless consumer experiences and new business opportunities for banks and service providers.

Customers today are more knowledgeable when it comes to the value of their data. It is a growing trend around the world for customers to demand more regulations and customer rights pertaining to data. Open banking and PSD2 are empowering financial services customers to control how their data is used. The new regulations are transforming the financial industry, creating powerful opportunities for companies that are best able to adapt.

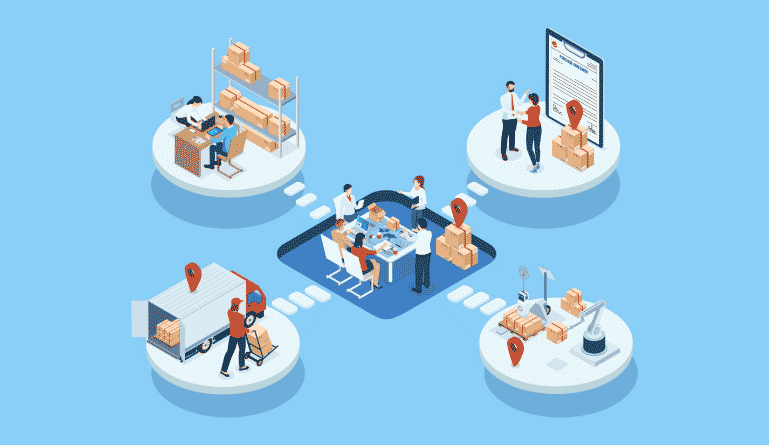

Open banking and PSD2 are requiring banks to let customers share their data securely with other banks and third parties to accelerate digital change, enable new types of banking services, and increase competitiveness across the banking sector. Both of these regulations require consent-based access to customer data for third-party service providers via bank APIs. This is transforming the financial services marketplace, as providers throughout the industry build innovative products and services around this newly available data.

For customers, open banking and PSD2 will create simpler, more convenient, and more customer-centric products and services, combined with unified visibility across all their accounts. This insight into spending patterns enables customers to make better decisions and take a more holistic approach to their personal financial management. Open banking and PSD2 are opening the door to next-generation fintech like Account Information Service Providers (AISPs) that will offer advice based on information collected from customers’ financial accounts.

These new regulations are ensuring banks and service providers are securing their customer’s data, and that this data is only accessed with explicit consent. Open banking and PSD2 are also having significant impacts on the dynamic and composition of the industry, as APIs make it possible for third parties to enter the banking ecosystem. These third parties will not need to invest in and maintain their own technical infrastructure, which will expedite innovation and competition.

Open banking and PSD2 are creating many openings for new business models and competitive opportunities, allowing for more startup banks and fintech providers. Financial institutions that cannot keep up with the changes in the industry will likely not survive the transformation of the banking ecosystem. There are many changes happening in the financial sector thanks to open banking.

Interested to know more about open banking? Click on the link below to watch a quick video and to download the whitepaper Open Banking, PSD2, and Financial Services Transformation.