More data and predictive technology is helping the finance industry better understand their customers and develop products that meet their needs using predictive customer analytics.

How can financial organizations benefit from predictive customer analytics?

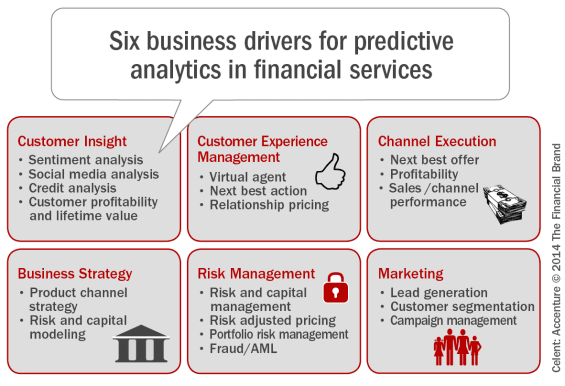

More and more companies are seeing benefits from predictive analytics. Greater amounts of data – and better technology to sort and understand that data – have given many organizations the ability to be more effective in almost every area of their business, from customer relationships to product development to marketing to budgeting and forecasting. The financial sector is no different.

Here are four ways that predictive customer analytics is helping finance organizations do better business.

Marketing

Good marketing has always been driven by data. Understanding what customers respond to is the foundation to building good marketing strategies that help brands reach more people. Predictive customer analytics can sort through the customer transactional data that tells marketers what current marketing efforts are effective and driving sales, purchases, sign-ups, applications, and other measures of success.

Predictive analytics gives you the insight to answer the questions, “What do my customers expect to see? What do they respond to? What kind of messages are important to them?” Understanding what your customers and target market are responding to leads to lower marketing costs and greater ROI on your marketing investment.

Customer Retention

Acquiring new customers can be expensive and time consuming, so a balanced business strategy includes hanging on to the customers you already have. One way to do this is through offering the kinds of products and services that they want. Predictive customer analytics is helpful in identifying and understanding what customers want and need.

Analytics can help businesses see the behavior of customers who have left in the past and businesses can develop a retention strategy to avoid losing customers going forward. If current customers begin to trend towards behaviors of past customers, businesses know that it might be time to step in and save the relationship with offers of rewards or other incentives.

Customer Retention

Add-on Sales and Services

Data analytics can also tell you about what customers are likely to use based on what they’re already using. For instance, if you have customers in a certain income bracket who statistically open retirement accounts after they establish a checking account, you may want to offer new checking customers the option of adding a retirement account at the time of sign up.

You can also determine what a customer might be more likely to consider purchasing based on other pieces of information, including their spending habits, purchases, and more. Using all the customer data at hand enables you to understand what additional products you can effectively earn their interest in, generating more business for you over time. The more products that a customer has with your financial company, the greater the likelihood that they will remain a long-time customer.

Reduced Fraud

Customer behaviors and purchase trends are also very useful when determining if a customer has been a victim of fraud. If a customer only ever makes purchases within the borders of their home zip code, a purchase made across the country would signal that something was amiss and allow your organization to contact the customer to establish if that purchase was legitimate. If a customer only uses their debit card to make grocery and gas purchases and the card is used for a large electronic purchase, a business can follow up with the client and see if this departure from typical behavior is fraudulent. Detecting the possibility of fraud early can save banks and businesses money, as well as serve to strengthen customer relationships.

Predictive analytics models are helping the financial industry in every area from customer service to marketing strategy. It’s likely that as technology continues to develop and predictive customer analytics are essential to more businesses that their impact will only grow.